Double declining method calculator

Calculating a double declining balance is not complex although it requires some considerations. For other factors besides double use the Declining Balance Method.

Double Declining Balance A Simple Depreciation Guide Bench Accounting

2 x 02 x 30000 12000 In the first year.

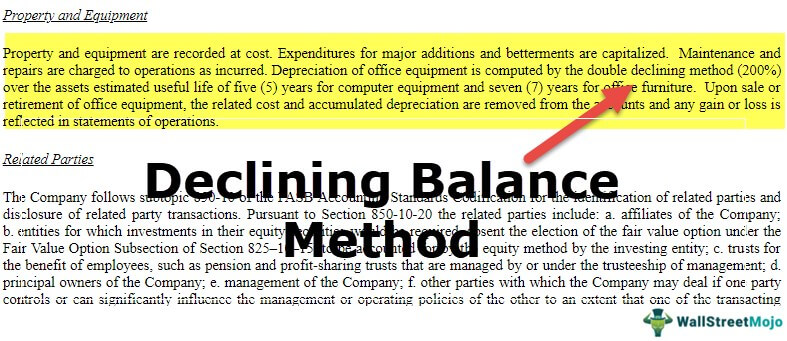

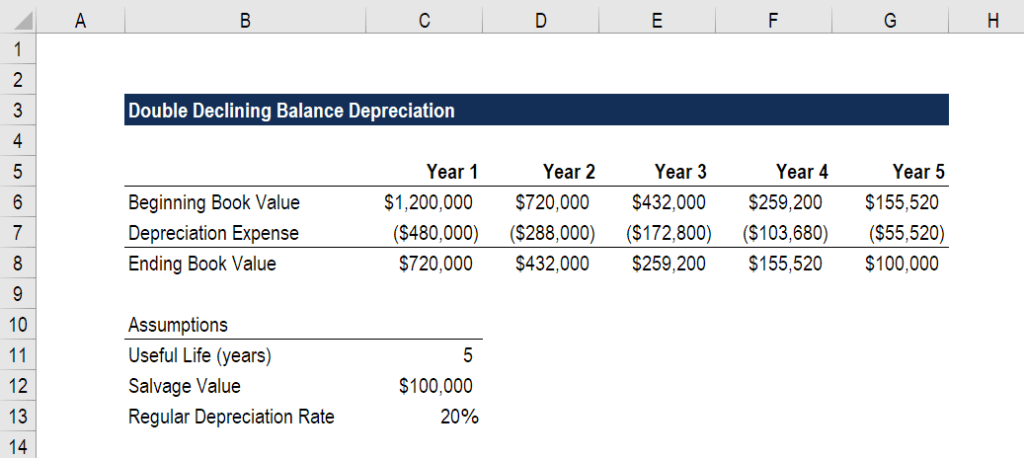

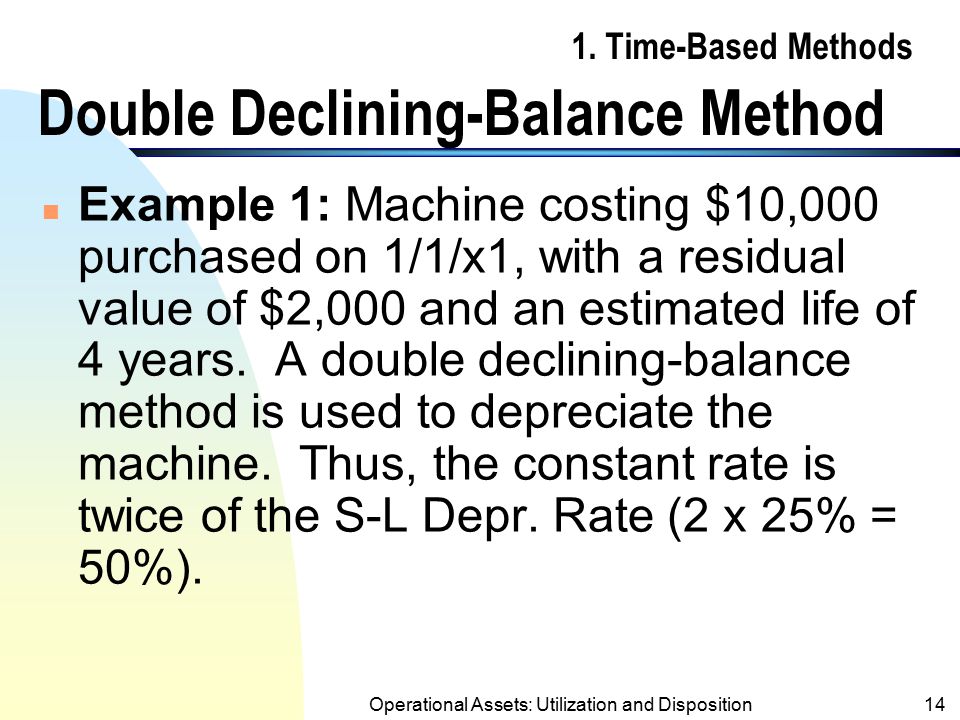

. Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15. Description of DDB function. Depreciation rate in the double-declining balance can be calculated by using the straight-line to multiply with the 2.

It would consist of multiplying two times the basic depreciation rate by the. The depreciation rate for the double-declining method is calculated as Depreciation rate for double-declining method 2 10 Depreciation rate for double-declining method 20 We. A declining balance method is a common.

How to calculate a double-declining balance There are several steps to calculating a double-declining balance using the following process. Determine the initial cost of the. However subtracting this amount from the book value.

Enter the straight line depreciation rate in the double declining depreciation formula along with the book value for this year. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Explanation of the Declining Balance Method of Depreciation.

Net book value Cost of fixed asset Accumulated depreciation. The formula to calculate Double Declining Balance Depreciation is. If you carried through with double declining depreciation as before you would calculate 40 of 432 as 17280.

Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200 depreciation. Returns a value specifying the depreciation of an asset for a specific time period using the double-declining balance method or some other method you specify.

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Of Deprecitiation Formula Examples

Double Declining Balance Depreciation Method Youtube

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

How To Use The Excel Db Function Exceljet

Double Declining Depreciation Calculator Efinancemanagement

Moins Que Pratique Brillant Balance Depreciation Retrait Murir Probleme

Double Declining Balance Depreciation Daily Business

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Fixed Assets

Double Declining Archives Double Entry Bookkeeping

Double Declining Depreciation Efinancemanagement

What Is The Double Declining Balance Depreciation Method Quora

Declining Balance Method Definition India Dictionary

Finance In Excel 6 Calculate Double Declining Balance Method Of Depreciation In Excel Youtube

Double Declining Balance Depreciation Guru